Welcome to our FAQ page and thank you for taking the time to learn about Next-Financing and what we do. The most popular question, “What services do you provide or what exactly do you do?”, is simple and complex at the same time. We understand that terms such as Fintech, Consumer Financing and Marketplace Lending are new to a lot of our website visitors, but feel free to ask questions – we are here to help.

Next-Financing is basically 2 companies in 1. On one side, we have our Consumer Financing Platform that enables Businesses of all types the ability to offer financing to their customers. The same platform works with our Healthcare Partners to provide patient and procedure financing for both elective procedures and high dollar deductibles. If you take a look at our “verticals” section, you will find the most popular Industry Types that leverage our financing platform. Today, consumers want options and our Financing Programs provides those options. Seriously, if you sell a product or service with an average ticket of $1,000 or more, we need to talk.

Ask yourself this question – Would you open your doors every day without having the ability to take credit cards for your $1,000 product? Not a chance! The same line of thinking should apply to offering financing options.

The second half of our company focuses on providing the very best Business Loan Products to fund our business partner’s growth. Whether you are a new business and need assistance with capital to get you through the first couple of years or the seasoned owner who has been in business for 20+ years. We have 100+ loan products/solutions to fit almost every situation you could imagine. Within those 100+ products are different combinations to add or subtract, so it’s literally overkill. Let us know what you need and we will build it.

Remember when we said being unique or different was exactly how we like to be described? It rings crystal clear when it comes to providing Business Loan Products. Our clients will never have to worry about being squeezed into 1 or 2 products that really don’t solve their current need or situation. We are going to listen to what our client needs and provide a customized solution to their need. We want to be far different than the MCA shops who are hammering business owners with 50+% interest, while taking their fat commissions and running far, far away. How about this approach? Why not do it right the first time and be your funding partner for the life of your business? That’s the goal….to be DIFFERENT.

We always tell our potential new clients that there are no silly questions regarding our Consumer Financing Platform or Suite of Business Loan Products. All of this is brand new to 99% of the world. FinTech and what is happening in the finance and banking world is in it’s infancy, so the boom has just begun. Unless your career is wrapped around the financing industry, it’s unlikely you are up to speed on all the latest news, so we wanted to put together a “living-breathing” FAQ page that would continue to grow, as this emerging industry grows. If you have a question that is not detailed and answered on this page, please feel free to email us and we will be happy to get you an answer asap.

If You have a question that is not listed on our FAQ page, please send your questions to: Info@Next-Financing.com

MarketPlace/Peer to Peer Lending

Q: What is Marketplace lending?

A: Marketplace lending is the practice of matching borrowers and lenders through an online platform. Borrowers are often able to gain access to funds quickly and typically at lower interest rates than banks, making it an attractive loan alternative to banks. The loans issued are often comprised of many different investors ranging from individuals to institutional investors. A similar term such as Peer-To-Peer lending (p2p) is used in this financing space, but it is generally synonymous with Marketplace lending.

The marketplace often functions in a faster, more efficient manner than loan officers at a bank branch. Even so, the risks are similar. Peer-to-peer and Marketplace Lending are relatively new. They’re regulated by the Securities and Exchange Commission and are required to register in individual states as well. Lending activities must comply with federal and state consumer lending laws.

Q: What is FinTech and why should I learn about it?

A: Financial technology, also known as FinTech, is an economic industry composed of companies that use technology to make financial services more efficient. Financial technology companies are generally startups founded with the purpose of disrupting incumbent financial systems and corporations that rely less on software. Think about companies such as Kabbage, Stripe, Lending Club, SoFi, Avant, Square and Next-Financing. Each company has their own niche to serve through technology driven lending or processing platforms, which is giving both business owners and consumers better/quicker loan products to offer and choose from.

The rise of FinTech has forever changed the way companies do business. The traditional model of a new business or medical practice turning directly to its local bank and/or a conventional lender is no longer the only choice they have and that only strengthens their position with more options to choose from.

From lending platforms to crowdsourcing to mobile payments, there has never been as many options to entrepreneurs as there is currently. It has never been cheaper to not only set-up your own business, but also to expand it.

The rise of the smartphone has massively changed the behavior of consumers. Thanks to the ‘always online’ culture we live in today – and the proliferation of services and apps that feed it – people can not only access information and data they had never previously been able to, they can do so while riding a bike at the gym.

A recent report from Accenture found that global investment in FinTech has skyrocketed from $930 million back in 2008 to over $12 billion by the beginning of 2015. In 2016, FinTech investment reached $15.2 billion with preliminary 2017 numbers expected to exceed $20 billion.

Q: What is the Next-Financing Platform all about?

A: It’s an innovative loan origination platform that solves a Multi-Billion Dollar problem. By bringing marketplace lending to the point of sale, Next-Financing provides better financing options for consumers when purchasing goods and services such as elective healthcare, dental care, veterinary care, furniture, home improvement, auto repair, HVAC, electronics, etc. Through the integration of strategic lending partners in combination with a unique balance sheet/marketplace lending structure, Next-Financing offers instant decisions and the most competitive loan product available for each level of credit through one streamlined platform.

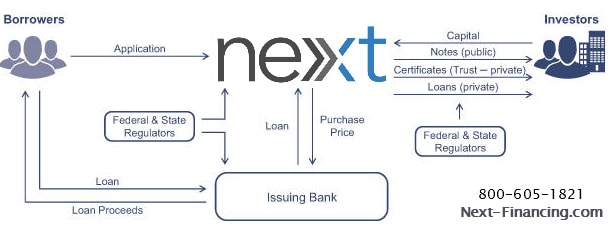

Q: Is Next-Financing a lender?

A: Next-Financing is not a bank or lender, we are a credit technology platform provider that is connected to federally insured, federal and state chartered financial institutions such as banks, credit unions. They provide the money and we provide the technology. With that said, Next-Financing does participate in funding their own business loans or we fund our own loans as a syndicate, which means we team up with another lender to split the funding and risk equally.

Q: If I already have a Prime or Near Prime lending partner for financing our customers who qualify, why do I need Next-Financing?

A: If your primary lender is declining 40% or more of your consumer/patient applicants who want to purchase your products or services, Next-Financing has an efficient and effective way to turn those declined applications into approvals with alternative lending options. Next-Financing’s Marketplace Lending Platform can significantly increase your approval rate by enabling 10-15 additional lending options for different credit profiles, thereby improving the likelihood of an approval of your customer from one of the lenders. Your customer has a better chance of being approved with access to 15-20 lenders, than an applicant with exposure to only 1 lender.

Q: Can we install your platform as our “Second Look” financing program if we are happy with our Primary Financing Company?

A: Yes. While it’s not the perfect scenario for our company, we understand the need to prove ourselves before we can ask you to make such a huge change in the way you operate your business. We’re not afraid to compete for Your business. Sometimes, there is confusion about what Second-look financing actually means, so let us explain it quickly and precisely. A business or healthcare practice will use a Second-Look Lending provider when an applicant is declined by their primary lender, but the applicant wants the opportunity to apply with an alternative lending source that may be more accommodating in their evaluation of the consumer’s credit and financing profile.

We use a “Soft Credit Pull”, so it will not impact their credit, so they have nothing to lose by completing a 1 minute application to get approved through our platform and network of lenders. Our Financing Platform covers all 3 primary credit tiers, which are prime, near prime and subprime. That means we approve down to a 600 where your primary lender currently approves down to a 680. That gives your business an extra 80 points to help approve more customers and capture more revenue. It’s a win-win situation for everyone involved.

Q: How will we approve a higher percentage of applicants with Next-Financing?

A: It’s very likely that your current lending partner approves down to a 680 Credit Score, while Next-Financing approves down to a 600 Credit Score. We do this with one application, one platform and one simple approval process, which takes 10 seconds. Next-Financing has partnered with industry leading lenders that span the credit spectrum, including prime, near-prime and sub-prime (We will also have a no credit check/in-house program for you that will be announced by June 2017.

You will see an increase in approvals, but also an increase in applications, since your customers will feel they have a chance of getting approved with your new credit standards. In addition, you will see more applications when you use our new credit approval information in your advertising and marketing. What’s going to happen when you put “We approve down to a 600 Credit Score” or “We have a financing program for everybody”??? These customers are tired to being told “no”. By adding our platform to your business, you are giving these customers a chance to buy what they want or need for themselves or their family. You’re doing all of this AND your revenues are increasing at the same time.

Q: What do you do with the customer’s personal information?

A: Next-Financing does not store or keep any personal data and your staff will never have access to a customer’s full social security number or birthday. All data is transmitted over a secure internet connection and all data from our application and funding processes are securely stored and only accessible by a select few individuals in our company with appropriate security/login credentials.

Q: Why should my business offer financing?

A: It’s simple – Make it easy for customers to purchase Your goods or services, which will increase sales, grow revenue and increase customer loyalty.

Our financing program should be looked at as a sales and marketing tool for your business. Increase sales by advertising financing options to attract more customers to your business and use one of our many promotional offers to close more sales. Some additional HUGE reasons to offer Next-Financing are listed below.

Attract New Customers:

Use our program to advertise affordable monthly payment options in conjunction with your “buy today” sales price. By advertising a low monthly payment, you’re appealing to those customers who can’t afford the total cash price of your product or service today. Use one of our special promotional offers as a marketing tool to drive more customers into your store.

Make Your Business Stand Out:

Use our finance program as a tool to distinguish yourself from the competition. Offer your customers a compelling offer by advertising one of our no interest (if paid in full) promotional offers along with a low, affordable, FIXED monthly payment. Let your customers know that you can approve a wide variety of credit profiles and to come in to apply for financing today.

Increase Average Ticket Size:

Advertising financing helps eliminate the focus on total price, and instead shifts the focus to affordability. By leading with financing, you’ll make your product more affordable with low monthly payments. Shift your focus away from total price and begin increasing your average ticket today.

Increase Conversion Rates:

By advertising affordable financing options online, you’re giving your customers another way to pay. Make your product more affordable and advertise one of our special financing promotional offers to increase conversion rates and see more “browsers” become “buyers.”

Gain New Leads Through Your Website:

Next-Financing is a great way for you to gain new customer leads online. Advertise banners on your website and encourage customers to apply for financing to check their rate, as it will not impact their credit score to simply check their options. Each customer’s information, regardless of whether they’re approved or not, is sent to your online portal and you’re notified via email. This enables you to build your customer database for proper follow up and marketing efforts.

Q: What are the fees to get started and are there monthly fees?

A: We hate fees just as much as you do. That’s why we don’t have any. No monthly fee, no setup fee, no minimums, no garbage fees whatsoever.

Q: What equipment do I have to buy to access your platform?

A: NONE. If you can access the internet, you can access the Next-Financing platform. No need to buy any equipment…our platform looks amazing on any device. (Mobile, Laptop, Tablet or Desktop)

Q: What does it cost me? What is the discount rate?

A: While we hate to be judged solely on price given the additional value we bring…we’re happy to say that our discount rates are extremely competitive and start as low as 0%. We can even build custom programs for larger customers with customized backend platforms and customized customer interfaces for both in-store and online. Our large partners can leverage our platform as a “White Label” solution, where they get all of the benefits of our technology and lending solutions, while having all of their tools, applications and the platform their staff uses everyday branded as their own.

Q: Can I offer special promotions with Next-Financing?

A: Currently, all loan offers are for fixed rate loans, but no interest promotions will be available in the new version of our financing platform.

Q: How does Next-Financing stack up to Care Credit, Synchrony or Lending Club?

A: Extremely well. Every banking institution has access to the same type of funds, so that part is all similar. The main difference is the technology being used to access those funds. That is our strong point. When you compare our ease of use, custom reporting, full analytics, multi-user interface, website integration capabilities, etc. You have our answer to how we stack up. We provide instant approvals (within 10 seconds), our discount rates are as low or LOWER for every credit tier, fund within 24-48 hours, assume all risk, provide a dedicated account manager to your business/practice, provide free access to our platform, email application capabilities, etc. – it goes on and on and on. We are very confident where we stack up against any of the competition.

Q: When do we get funded once a sale is made?

A: Once a sale is made, loan documents are signed and the product or service is delivered, the funds from the sale will be deposited into your business account within 48 hours. The funding process is similar in how long it takes for credit card sales to batch and fund into your account.

Q: Is Next-Financing’s platform easy for my staff to use?

A: Ease of use was one of the 2 most important factors when we put this platform together. We knew we had to be able to approve more applicants, but we also knew that we had to make it easy for the staff to use. We are fully aware that if it’s cumbersome and difficult to use, the staff will not use it and will revert back to what they know and are comfortable with, which is bad for us and your business. It’s extremely easy to use and it’s one of the top 3 compliments we receive after installing our platform and training the staff. Ease of use is a BIG deal to us, as it is you and your staff.

Q: How can we get more customers interested in applying for financing?

A: We tell everyone that it doesn’t matter if you have the best financing program in the world, if nobody knows about it. Without marketing and education, our platform will never be used; and again, we all fail. Your customers need to be informed or educated that you offer financing for your products and services and it covers all credit tiers from A-E. Educate them on the fact that we use a “soft credit pull”, which doesn’t impact their credit….so, they truly have NOTHING to lose by applying to see what their options will be. They may be pleasantly surprised and end up spending more than they originally planned. Education, education, education. Signage, Signage, Signage. Website buttons/Banners, including it in your marketing and advertising and simply having an open dialogue with your customers. More times than not, you will be making their day when you tell them they can pay for their purchase with monthly payments instead of paying for all of it today.