Smart Consumer Financing – Get Started Today

Why Next-Financing?

It’s simple, Smart Consumer Financing provides more approvals, ease of use platform, low discount rates, one application, full reporting, analytics, etc. You no longer need 2, 3, or even 4 financing programs to satisfy every type of customer that walks into your business. Submit every application into Next-Financing’s Consumer Financing Platform, sit back, and watch your approval rates soar. Because we have multiple lending partners integrated into one easy-to-use platform, obtaining financing for customers with great credit to no credit has never been easier. Guaranteed highest approval percentage & set-up is FREE! Now that’s Smart Consumer Financing.

Click On The “Let’s Get Started” Button Below & Start Offering Smart Consumer Financing in 3-5 Days!

Seamless Technology = Seamless Smart Approvals

- 1 fast, easy application for all borrowers.

- Guaranteed highest approval percentage.

- Instant approvals – 30 seconds or less.

- Approvals down to a 400 credit score.

- Direct funding to your business checking account within 24-48 hours.

- No set-up fees to get started offering Smart Consumer Financing.

- Smart Technology – No equipment to buy or lease.

- 100% paperless – Smart & Efficient.

- Detailed reporting back office with analytics, tracking, and customer profile database.

- Works on any device – connection to the internet is required.

- Customers can apply privately from their phones or from the comfort of their homes.

- Email or Text application to your customer for pre-approved smart consumer financing.

- Smart Enabled Website application buttons, banners, and widgets are included.

- Customized Smart Websites with built-in financing and payment solutions are available.

- We consider businesses of all types. We want to help your business grow their sales revenue month over month – without paying more than you should.

**Our business is to help your business thrive. We do our part by keeping our discount rates low so you can concentrate on your customers and your bottom line. We work together with the merchant to create smart and innovative decisions to increase their revenue and spend more time with their customers.

Smart Consumer Financing: How it Works for Merchants

Our smart/multi-lender financing platform covers the entire spectrum of credit from prime to subprime.

- Your customer completes a simple application – from their phone or any device with internet access. Your application can be branded with your logo for further customization.

- If approved, they’ll instantly receive financing options to review.

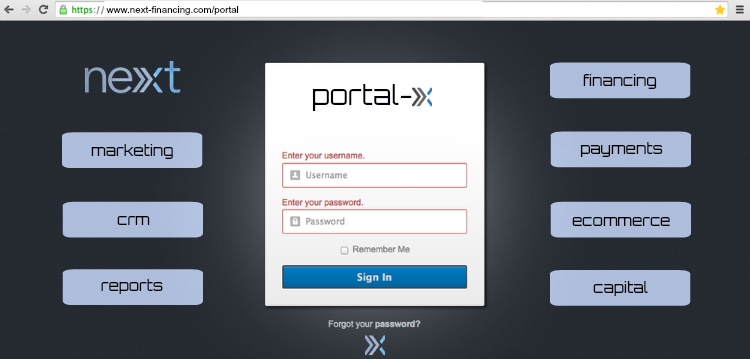

- Merchants will be notified to create a purchase order from your merchant dashboard – located in your back office portal.

- Customer verifies the purchase order and Next-Financing completes the transaction, depositing the funds directly into the merchant’s bank account.

Smart Consumer Financing: How it Works for Consumers

- Obtain the Merchant ID of the business where you’d like to make a purchase (the merchant will have that info ready for you.)

- Complete a simple one-page application & get instantly matched with financing options for your purchase.

- Select the financing option that works best for you and complete the process.

- Verify & approve the details of your purchase and Next-Financing takes care of the rest – completing your purchase with the business.

Smart & Fair Terms with Fixed Monthly Payments

We aren’t a credit card and don’t charge outrageous interest rates to consumers. Big bank credit cards require no interest promotions because of the high-interest rates that come with their cards. The Next-Financing platform provides consumers with smart & competitive interest rates, fixed terms, and fixed monthly payments. Approval offers and interest rates will vary, as the approvals are credit profile-driven. Even though interest rates have gone up, they still range from 7.99% – 35.99%. Smart Money Wins Every time!

Smart Consumer Financing Approves More Customers

Reduce those awkward declined conversations with smart & productive conversations. As a result, approve more customers, as our platform approves down to a 400 credit score. Our platform provides the highest approval percentage in the industry.

Our easy-to-use platform gives you access to multiple financing sources, helping to increase the chance your customer gets approved for financing the first time. With Smart Consumer Financing, you can reduce how often you have those awkward decline conversations.

We promote smart credit management with our client’s customers. They can “check their rate” before actually applying. We only perform a “soft” credit pull to provide their financing offers. Once they agree and choose to proceed with one of their smart financing options, that is when the official “hard” credit pull happens. There is no risk to your customer to check out their options. Almost ALL other consumer finance companies do not offer that ability to customers.

Smart Consumer Financing Details

Smart Loan Amounts:

Loan amounts currently range from $500 – $50,000 and are consistent with the merchant’s inventory they sell to their customers. We’re not going to approve a $10,000 loan for a $5,000 bike to help the merchant make an additional $5K. We want smart/common sense across the board for the merchants & clients. Let’s make each transaction a win/win.

Smart Discount Fee Programs:

While we hate to be judged solely on price due to the additional value we bring to the table, we are happy to say that our discount rate is only 5-10% (depending on the risk level of the applicant and product being purchased or procedure being performed). Yes, that’s correct….we only charge a flat 5-10% discount fee on all financed transactions. As a business owner, you are able to include the 5-10% fee in the total sales price, which would “net” you a 0% discount fee program. It’s similar to credit card processing’s “cash-discount” programs. We have to be smart about our business as well, but that doesn’t mean we have to overcharge our clients.

Sub-prime applicants (400-600 credit score) will produce approvals with higher discount fees – typically from 15% to 30%. If you don’t want to accept these applicants & additional business, we can simply turn these programs off during our initial set-up/configuration process.

Smart Interest Rates:

Our interest rates and terms are 100% fixed, giving your customers a consistent, fixed monthly payment. Interest rates start at 7.99% with no prepayment penalties. We consider all business types for our consumer financing program.

Risk-Free for Our Business Owners:

With Next-Financing, Business Owners have zero risk on customer defaults. If something happens and your customer can no longer pay their bill, it’s not your problem. We expect assistance in trying to recapture those funds, but you didn’t underwrite the loan, so you’re not responsible for servicing the loan. I’m not sure if that’s smart or simply common sense.

Smart Funding Time to Your Bank Account:

Why should it take 5-10 business days for a merchant to receive their money for goods sold or performances rendered? That makes absolutely no sense at all. Let’s keep it moving and keep the cash register ringing. Businesses are funded directly into their business checking account – via ACH within 24-48 hours.

Smart Loan Terms:

Loan terms range from 12-72 months, which line up with the amount of the purchase or procedure. Let’s not create bad debt where it doesn’t have to even be considered. We want our merchants to make a profit and be fair to their customers at the same time.

No Hardware Needed to Buy or Lease:

Our solution is web-based, so if you can access the internet, you can access Next-Financing. No need to buy any equipment…our platform looks amazing on any device. Why is this a smart and important point? Most payment or financing companies ONLY sell or lease equipment to make over-the-top money. We’re talking silly margins and it needs to stop. It stops with Next-Financing.

No Set-Up Fees to Get Started:

We hate fees just as much as you do. That’s why we don’t charge any to get started.

Special Financing Promotions:

6 & 12 Month Interest-Free Promotions are available for specific financing programs and applicants. Please ask about including those programs during our set-up/configuration process.

Getting Started Is As Easy As 1-2-3

- Application/Agreement, Driver’s License, Proof of Ownership & Return/Cancellation Policy.

- Approval of your new account within 2-5 days.

- Set-up, customization, training, and then start selling!

A Smart & Simple Setup Process

Get started today – no cost! Submit the required documents and your new account, custom web application, and back-office portal will be ready to go within 3-5 business days. Once approved, you will receive a welcome email/letter with a link to your custom web application, login credentials to your back office portal, and instructions to schedule training. Our training program will help you and your team communicate and market your new smart financing options to your customers. Welcome to The NEXT Big Thing in Financing!

Offer Smart Consumer Financing Today!

Increase Sales and Grow Revenue:

Our financing program should be looked at as a sales and marketing tool for your business. Increase sales by advertising financing options to attract more customers to your business. Financing their purchase may be the only way they can pay for your product/service.

Attract New Customers:

Use your new financing program to advertise affordable monthly payment options in conjunction with your “buy today” sales price. By advertising a low monthly payment, you’re appealing to those customers who can’t afford the total cash price of your product or service today. Use these affordable monthly payment options as a marketing tool to drive more customers into your business.

Make Your Business Stand Out:

Use your new financing program as a way to distinguish yourself from the competition. Offer your customers a compelling offer by advertising a low, affordable, FIXED monthly payment. Let your customers know that you can approve a wide variety of credit profiles and encourage them to apply for financing today. Remember, they have nothing to lose – there is no impact on their credit score for applying.

Increase Average Ticket Size:

Use your new financing program to increase the average ticket size on purchases across the board. Use financing as a way to upsell your customers or offer “packaged” products/services to increase your average sale amount.

Increase Conversion Rates:

By advertising affordable financing options online, you’re giving your customers another way to pay. Make your product more affordable and advertise affordable payment options to increase conversion rates and see more “browsers” become “buyers.” Your back-end reporting tool with customized reports and analytics will show you detailed information for your business and how Next-Financing is helping grow your revenue.

Web-Based – 100% Paperless:

No longer are you having to deal with scanning documents or creating paper files, as everything is done via the internet and is 100% paperless. Instant approvals, ease of use, and no more paper mess.

Click On The “Let’s Get Started” Button Below & Start Offering Consumer Financing!